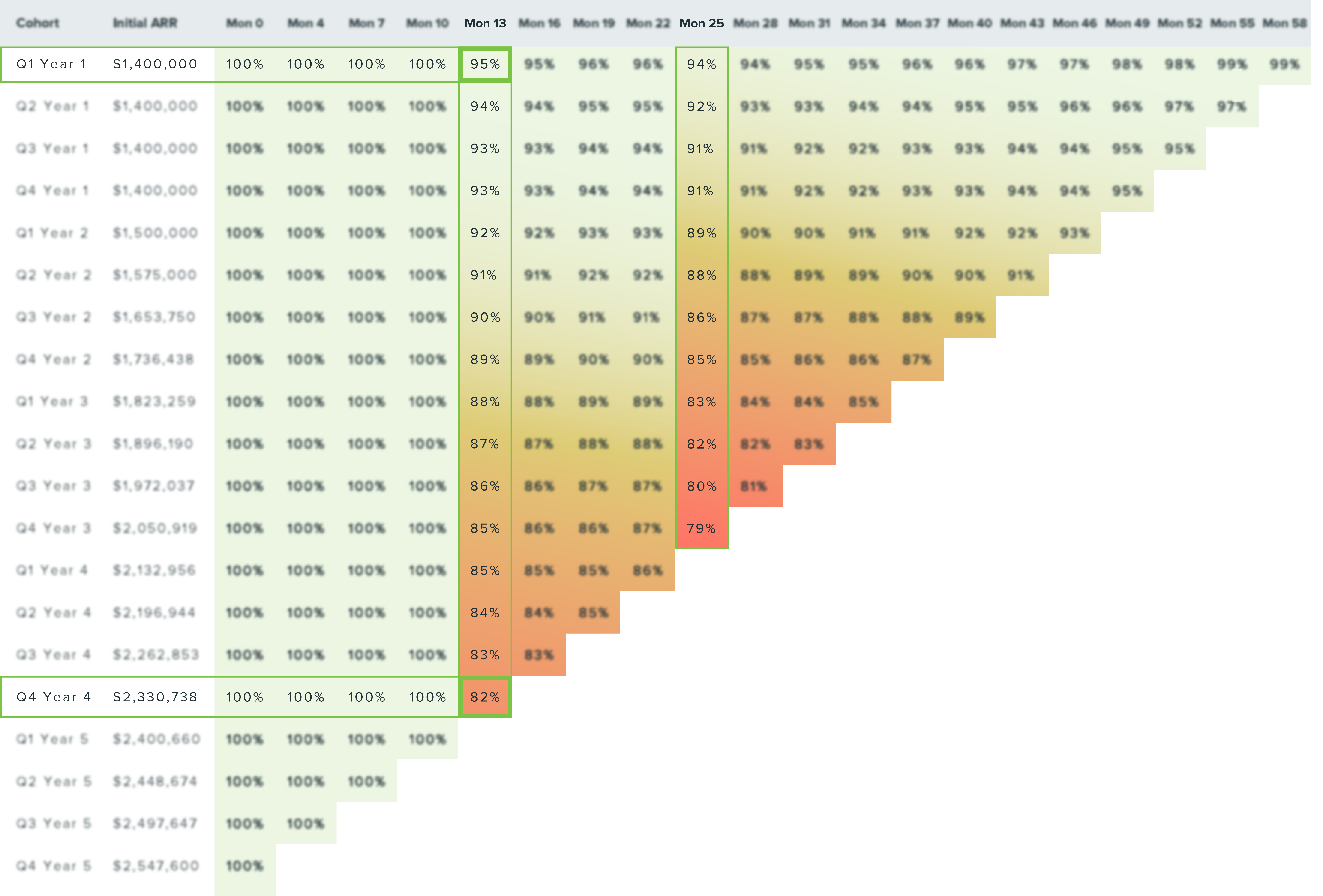

Churn is not a number – it’s a behavior. SaaS companies know the cancerous effect of churn, but often define it as a single number. Churn is typically calculated by observing the number of customers or revenue lost over a period and comparing against the beginning balance. While this approach provides a succinct headline number, such as 8% annual churn, it does not effectively explain trends in customer behavior.

Period-over-period metrics are prone to volatility and are easily skewed by exogenous variables. Inaccuracies are further compounded if the retention numbers are used to feed calculations of Expected Lifetime (eLT) and Return on Customer Acquisition Cost (rCAC). Operators seeking an accurate understanding of retention must instead segment customers by vintage-based cohorts and chart retention over time. Note, while this paper focuses on net dollar retention, the framework discussed below applies equally to gross dollar retention and logo retention.